Delivering pre-eligible to mortgage loans used to be the newest exemption, perhaps not this new laws. Out of 2004 to 2017, only 20% away from individuals tried pre-acceptance before you apply to have home financing. But in the current roaring housing market, with a great pre-recognition is important. Home financing pre-recognition page allows people know the large and you may lower closes out-of their finances because they look at property. So it preserves the trouble out of considering land which are not an informed match. As well as, a great pre-recognition makes an offer much more aggressive when the correct domestic is. When a vendor understands you are currently several methods towards the finishing the credit process, it provides them depend on the transaction tend to romantic and you may puts your a short time ahead on timeline.

Just like the financial pre-approvals are usual habit, we know potential homeowners keeps questions. Which Indiana Professionals Borrowing from the bank Union (IMCU) help guide to financial pre-acceptance discusses the axioms and several of your own better information to help you incorporate with confidence and store having just thrill regarding a home pick.

Pre-Recognition vs Pre-Qualified: What’s the Improvement?

A home loan pre-acceptance is a straightforward respond to from how much you are qualified to use and you will exactly what your interest rate is actually predicted getting. This is not you can to locate a home loan pre-approval rather than a credit check.

While doing so, financial pre-official certification are often provided by your credit rating assortment merely. Your own commission records, debt-to-money proportion, and you may comparable information are not taken into consideration. Due to the fact recommendations found in an effective pre-qualification isnt over, there can be minimal confidence might receive the luxury away from your own quote after you submit the full software. At the same time, when you find yourself merely starting a good pre-certification are higher to set sensible expectations in place of a card check: IMCU offers an effective pre-qualification calculator right here.

Good pre-recognition is also perhaps not a good 100% guarantee you could use. However, because assesses your own complete economic character along side path of one’s history a couple of years, it is much more resilient than simply an excellent pre-certification. Guaranteeing their a position, earnings, and you can credit history kits you as much as use in this a realistic variety, although finally loan conditions and interest you’ll differ. Indeed, particular home providers will not also thought a deal that’s maybe not pre-accepted.

How do Financial institutions Determine Pre-Recognition?

The two biggest things one to perception just how much you can borrow inside the home financing is your revenue and your debt. For instance, whenever you are wanting to know Just how much house ought i pay for if i build $6,000 thirty days?, the total amount you draw in is part of the picture. A unique chief ability is where far your already owe in expenses to other people.

According to the governance of the User Monetary Coverage Agency, lenders need to generally impose good 43% debt-to-earnings proportion (DTI). Meaning if 20% of one’s income is supposed into most other obligations, you could potentially simply qualify to spend at most 23% of your earnings towards the a home fee. And when you obtain up to brand new maximum your qualify for, you’ve got a difficult time bringing provided other credit and you payday loan Terramuggus can fund. Always, you want at least 10% of one’s earnings to be available for the mortgage manageable to obtain resource.

When you’re wondering the way to get increased financial that have lower money, paying down financial obligation is among the how do you create very. (We’ll safety alot more info in the next part.)

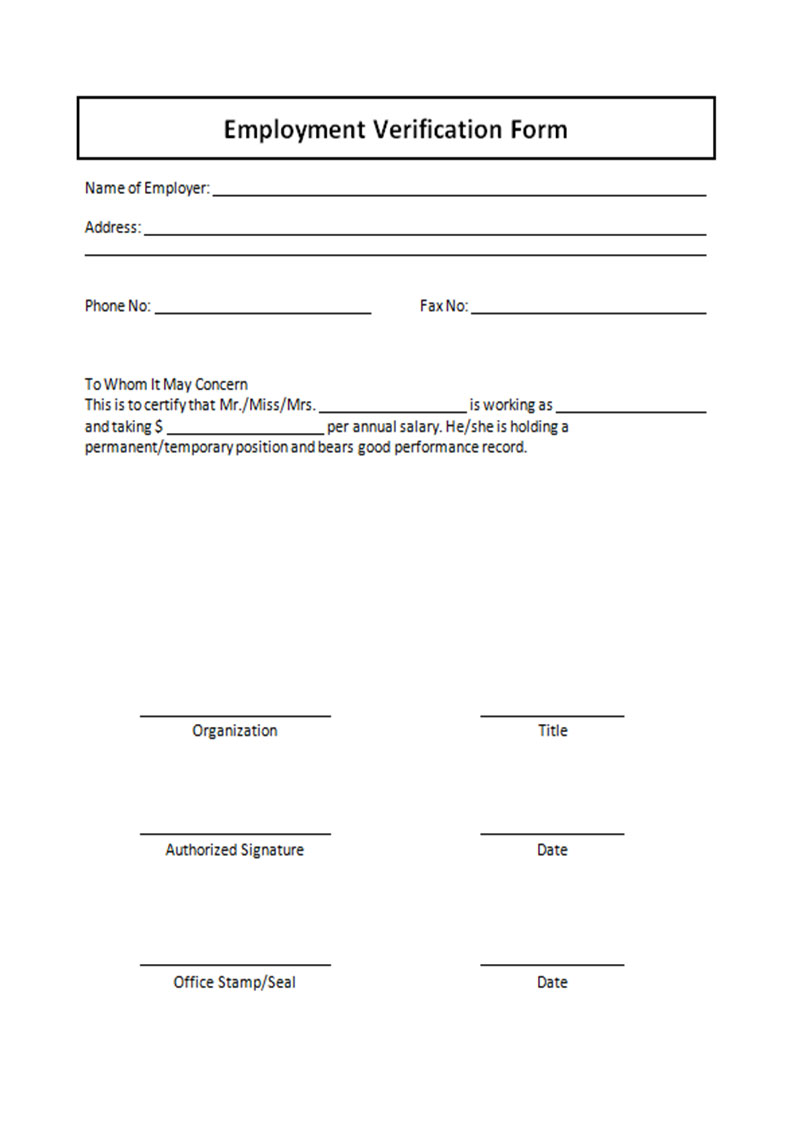

Bringing pre-recognized having a home loan requires a few days so you can per week, even though you begin the process online. You given that candidate would have to fill in things like spend stubs, W-2s, and you can savings account statements. you will you desire files to suit your past 24 months from work. Your loan officer requires sometime to ensure your current role otherwise ask for much more information from you and other sources. The greater amount of details and you can papers you may have easily accessible, the faster this process may go. Sometimes, if you’re extremely planned while the decision is straightforward, you are able to get pre-recognized within a few days.