To help you safe approval getting a conventional mortgage, its vital to show no less than 24 months of steady, consistent income with similar company otherwise from inside the exact same profession.

- Salary otherwise every hour money

- Bonuses

- Overtime

- Commission

- Part-time money

- Self-a job

- Contract otherwise concert performs

Lenders be able to consider more sources of earnings having being qualified objectives. Including some earnings streams particularly senior years money, alimony, child help, and you may Public Defense costs. Yet not, it is very important note that if you discover help repayments such as alimony otherwise youngster assistance, this type of repayments should be anticipated to last for no less than about three age immediately after acquiring the home loan.

All the income sources have to be reported using your newest W-2s, taxation statements, bank statements, and you will pay stubs. Self-employed borrowers, simultaneously, generally speaking offer at the least two years off team tax statements in the inclusion in order to individual tax statements.

Debt-to-income proportion

When determining your qualifications getting a home loan, lenders look at your earnings when comparing to current financial obligation debt. Debt-to-income ratio (DTI) means the fresh portion of the disgusting month-to-month money designated on the monthly obligations payments (such as the coming homeloan payment).

To have a traditional mortgage, loan providers choose an excellent DTI ratio under 36 per cent. Although not, DTIs around 43% can be acceptance. Some times, you may even meet the requirements with an effective DTI all the way to forty-five-50%, if you have compensating facts. Such points could be a high credit score otherwise extreme bucks supplies held throughout the financial.

To assess your own DTI proportion, sound right your own monthly financial obligation repayments and separate you to contribution by your monthly gross income. Like, if you have a gross income out-of $5,000 and you may monthly personal debt payments from $step 1,500, your debt-to-earnings proportion was 30 %.

Mortgage restrictions

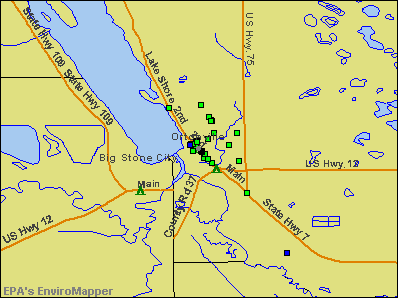

To get a traditional compliant financial, your loan number need fall within this regional mortgage restrictions lay by the latest Government Property Money Service (FHFA). Such mortgage constraints change annually, consequently they are high during the section that have exceedingly high assets opinions. For the 2024, new compliant loan restriction having a single-family home for the majority of your You.S. try $ , if you are high-worthy of mortgage constraints rise to $ . You can examine your own area’s newest mortgage restrictions right here.

In case loan wide variety exceed the specific maximum, borrowers must make an application for a low-conforming loan otherwise good jumbo financing. Jumbo financing generally speaking require down payments ranging between 10% and you may 20% off.

Property conditions

- Single-house otherwise multiple-product family (only about five gadgets)

- A residence, not a professional property

Simultaneously, loan providers has cover set up to ensure that you dont obtain more the home is worth. Once you’ve a signed pick agreement, the home loan company often plan for a home https://paydayloanalabama.com/bridgeport/ assessment to confirm the marketing speed cannot meet or exceed the newest property’s real market value.

Antique loan conditions FAQ

Its better to qualify for a normal financing than simply of a lot basic-big date home buyers predict. You may need at least credit score from 620 as well as one or two consecutive many years of steady money and you may a position. Delivering recognized as well as means a minimum down-payment between 3 and you can 5 per cent and you may a debt-to-earnings proportion below 43% oftentimes.

In the present mortgage landscape, the notion one a 20% down-payment is needed try a myth. There are numerous financial apps, in addition to old-fashioned financing, that offer significantly more versatile downpayment solutions. Specific first-day homebuyers should buy with only step 3 percent down, while some will require at the very least 5 %. Remember that to acquire a property having below 20 percent off requires individual financial insurance.