Applying for a good re-finance that have a great co-consumer can provide you with an enhance however, just remember that , discover certain strings affixed. Your own refinance merchant can realize their co-customer for cash if you’re unable to pay back your mortgage. Make sure to are designed for your instalments every month before you sign up for a re-finance and make sure to maintain a great relationship with your co-consumer.

2. FHA Streamline Refinance

That one enables you to re-finance a preexisting FHA loan rather than the usual credit score assessment and you may income verification. Occasionally, in addition there are a keen FHA Streamline re-finance without an appraisal.

- You should read plain old credit assessment needs if you prefer so you’re able to re-finance a traditional financing toward an enthusiastic FHA mortgage or vice versa.

- You must including look for a real net work with after their re-finance. A concrete benefit was less monthly payment or a beneficial all the way down interest.

- Your monthly payment cant raise of the more than $fifty in the event that its an expression reduced amount of step 3 or more age. Whether or not it does, youll must follow a complete refinance standards.

- You can only have you to definitely 31-day later payment during the last season and you will none about history half a year.

step 3. Cash-Aside Re-finance

That bottom line to consider from the refinancing as opposed to a credit assessment: You could simply re-finance their price or title. Youll should have the very least credit rating of at least 620 when you need to capture an earnings-aside re-finance in most conditions. Rocket Home loan is going to do a Virtual assistant bucks-out re-finance that have an average FICO Rating as low as 580 for folks who keep ten% guarantee at home after the refinance.

This is an excellent average borrowing from the bank choice for refinancing, you could make use of the money to pay down most debt that could then change your credit score.

Mortgage loans have some of your own lower interest levels of any sorts of debt. Including, the typical fixed-price mortgage loan keeps an apr significantly less than six% only at that composing, and the average mastercard has an apr more than sixteen.5%.

Providing a finances-away refinance and you can settling your balance helps you go back on course financially, specifically if you enjoys a great number of financial obligation. You can consolidate your debt that have you to percentage toward mortgage financial unlike worrying about shed payments all over numerous cards. This will help you replace your score through the years.

Look at and monitor your credit score.

Devote some time to increase their rating (and check your credit report to own discrepancies) before you could re-finance https://clickcashadvance.com/loans/line-of-credit/. Increasing your credit score unlocks far more refinancing solutions and can help you secure the lower interest possible. Make use of these quick tips to improve your credit rating.

Become familiar with Your Credit

The first thing to create are rating a glance at your credit report. You’ll find mistakes generated and sometimes you can be the fresh new victim of id theft also. Examining your own borrowing don’t merely allow you to see just what need to improve, however, will let you catch things that your usually do not actually admit.

All of our family on Skyrocket Homes SM enables you to check your credit each week versus inside your get. step one Youll receive your 100 % free TransUnion VantageScore 3.0 credit rating and report. Additionally you score custom knowledge with the in which their borrowing is increase.

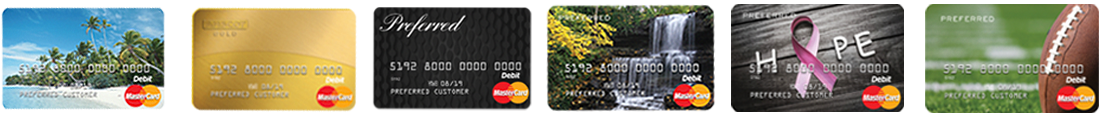

Imagine A secured Bank card

You will possibly not be eligible for financing otherwise traditional charge card. A secured credit enables one to build borrowing from the bank once you have to. Your get off in initial deposit with your financial should you get a covered cards. You to definitely put following becomes the credit line.