- Draw because the This new

- Save

- Sign-up

- Mute

- Join Feed

- Permalink

- Report Poor Posts

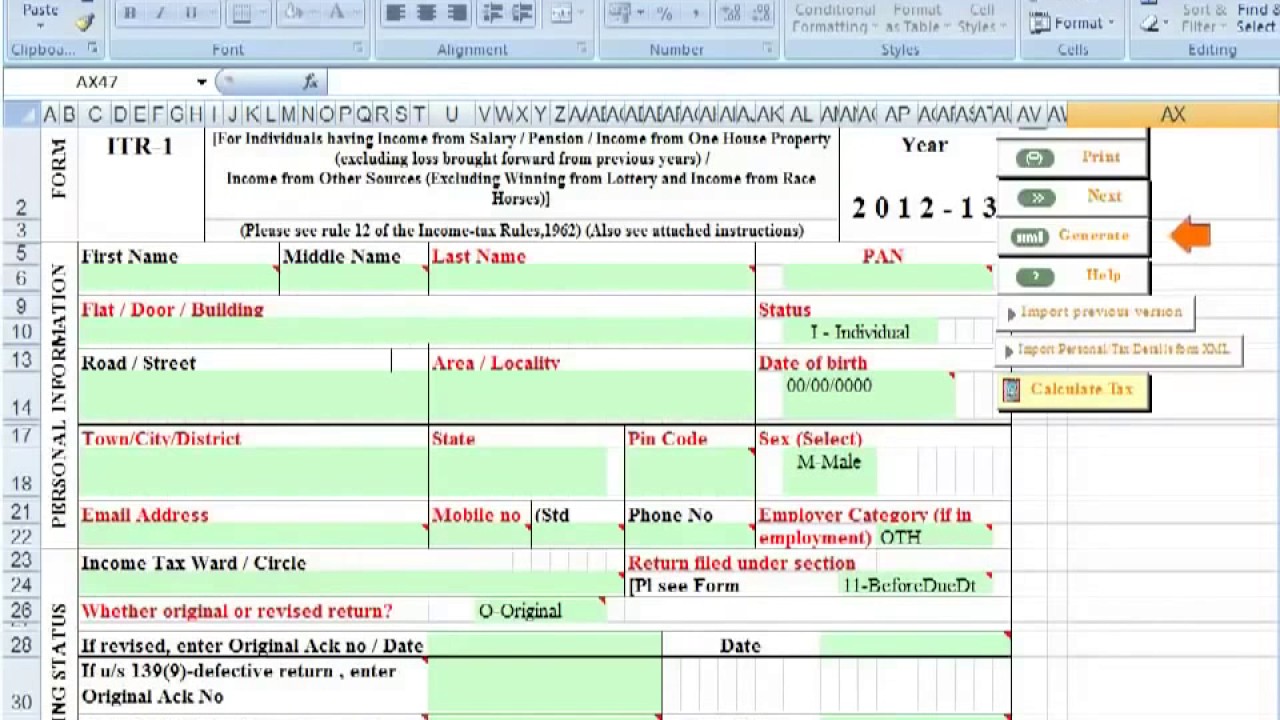

Mortgage ConditionsThe financing criteria, certain so you can circumstances necessary to document the loan application, are as follows

Very first time obtaining a home loan and i thought I ought to features discover here very first. I just used that have NFCU and you may gotten instant pre recognition. To purchase $700,000 house with $eight hundred,000 off. Yearly paycheck is actually $205k plus thirty five% extra. I am not using with my partner as the he’s no income and it has a mortgage inside the term simply (we live-in MO). We express mutual bank and that i have individual bank as well. I simply do not require your into the loan, my financial score is actually mid in order to large 600’s no lates early in the day two years zero collections, merely carry some personal credit card debt.

$twenty-six,000 into the credit debt (24% total utilization). Before obtaining the borrowed funds, I got aside a personal loan away from Sofi so you can combine credit credit debt for the a lesser interest rate (eg fifty% lower rate) therefore i you may shell out every thing of in 2 decades. Few pay it off today however, want to keep cash in my personal lender thus i has actually exchangeability. The sofi mortgage actually to my credit report but really on account of timing of these and you will mortgage software, I honestly cannot bear in mind if i shared it an obligations with the application with NFCU as i just got the borrowed funds and had not also produced a payment yet ,, instead We indexed my personal credit debt. We paid my personal $26k credit card debt and you may alternatively has an effective $22k loan, however, my personal credit card $0 equilibrium failed to article prior to NFCU went my credit. Again – timing. Plus bc my better half is not with the mortgage with his home loan is not within my identity it’s not on my credit file and you may not a personal debt that we owe.

All that said, I experienced pre-recognition just after applying, (5.75% 5/5 Sleeve), secured on rates and you may had conditional approval two days once posting every my personal files (price, W2;s, bank comments, spend stubs and you will declaration that i real time rent-free and you may letter that i can perhaps work secluded). Now I’ve financing processor chip and you may going into UW – below are the fresh 18 conditions. We bolded the ones Really don’t understand. Is also people advise?

In addition to the combined membership I give my better half will teach a beneficial $600 fee to our bank that is not a financial obligation one We noted because it’s maybe not exploit or perhaps in my name. Often which feel some thing UW asks myself regarding or since the my credit already acknowledged and it is perhaps not that loan position, its a non question?

Exact same financial obligation I had whenever borrowing from the bank accepted to possess mortgage just consolidated it in order to a lowered interest rate and so i can pay it from quicker.

Whatever else I should be concerned about? I favor my personal LO the woman is started at the top of everything and really receptive thus have to just generate one to label as well as have all the requirements in that I’m able to – that which you not when you look at the committed seems earliest articles if you ask me even if zero sellar concessions with the price submitted so unclear in which you to definitely is coming from. And i also provided th4 lender report guaranteeing $400k twice therefore unclear exactly how else to verify they.

If we dont receive all asked papers by the , we’ll, unfortuitously, be unable to over said of one’s borrowing request.

I must indicates the latest inquiries (Sofi loan) and you can curious if my personal reason a lot more than is reasonable?

Limitation financing may not be on all of the tactics. That it mortgage approval letter represents Navy Federal’s loan recognition simply and you can isnt a hope off acceptance from the a private Home loan Insurance rates Team. This comes with one agent or representative credit on the Ohio personal loans transformation contract. At the mercy of change in the event that current money are increasingly being used. Supplier concessions not to ever exceed:ten Ratified conversion process contract along with addendums/attachments (where you can find be bought). Loan is additionally subject to coverage and procedural alter. All borrowing data files have to be no more than five days dated with the note time. Relate to the newest Offering Book to own direction towards ages of this new appraisal otherwise assets examination declaration. In the event your put is utilized while making one the main borrower’s lowest share that has to come from their own funds, the main cause from money towards deposit should be affirmed.

To work out the importance greeting (assessment waiver) render which have representation and you can guarantee recovery towards the worthy of, standing, and you will marketability of subject assets, the borrowed funds beginning file need certainly to through the Casefile ID and you can Unique Element Code 801. If for example the really worth acceptance (appraisal waiver) give isnt resolved, an appraisal becomes necessary for it transaction and also the loan don’t end up being sold having Special Element Password 801. Keep in mind that DU doesn’t identify all really worth allowed (appraisal waiver) ineligible purchases, plus Texas Section fifty(a)(6) mortgages; usually refer to this new Offering Help guide to verify qualifications. Reference the latest Selling Book for additional information. In the event the query contributed to the brand new personal debt, promote papers of terms and conditions.