“My personal mortgage loan administrator is telling me personally I can’t rating an effective financing no matter what my complete-date employment in the a major distribution company and you can strong earnings, since, commercially, I am utilized by an effective staffing agency. They endure to the on the a three year continuity of cash. what does that mean? So is this loan administrator correct? Do some of this sound strange? Are you experiencing one strategies for one possibilities I’d has?”

You can qualify for home financing if you are employed because of a great staffing agencies otherwise temp department. The solution to such inquiries have the brand new depths out-of federal financial contacts and you may institution direction. This is what Fannie mae claims:

Secure and you can Predictable Earnings

Fannie Mae’s underwriting guidance highlight the newest continuity out of good borrower’s stable earnings https://paydayloansconnecticut.com/chimney-point/. The new secure and you can credible circulate of income is actually an option attention in the home mortgage underwriting. Individuals who changes operate frequently, but that are however in a position to secure uniform and you may foreseeable money, also are considered to has a professional circulate cash having being qualified intentions.

Continuity of income

A key driver regarding successful home ownership is trust most of the money found in qualifying this new borrower will remain obtained of the the new debtor to the foreseeable future. Unless the lending company enjoys education on the contrary, when your money doesn’t always have a defined conclusion day and you can the fresh new applicable reputation for acknowledgment of your own income is recorded (for every single the income type), the lending company will get stop the income try stable, foreseeable, and you can planning remain. The lender isnt anticipated to consult most documentation regarding the borrower.

If the revenue stream does have a precise expiration big date otherwise is dependent on the newest destruction of a secured asset account and other restricted work for, the lending company need document the chances of went on acknowledgment of income for at least 36 months.

If your bank is actually notified the brand new borrower is transitioning to an excellent down shell out structure (for example: due to pending old-age), the financial institution need certainly to utilize the straight down amount to qualify the fresh new borrower.

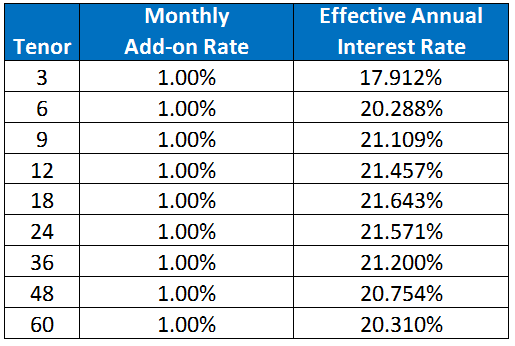

Next table includes samples of earnings models with and rather than outlined termination schedules. This information is agreed to help loan providers inside the determining whether a lot more income records is generally necessary to help a good around three-seasons continuance. Note that lenders will always be responsible for deciding to make the last devotion out-of perhaps the borrower’s specific revenue stream provides the precise termination big date.

As you care able to see, Federal national mortgage association helps it be very clear one to so long as your earnings has been steady and consistent, whether or not you have altered efforts appear to otherwise benefit an effective staffing department, the cash can be used to qualify for a home loan.

When it comes to Continuity of cash conditions – they don’t connect with feet income money, so there isn’t any need to bother about being required to confirm that your temp assignment won’t result in the next three-years go out.

- You will find another type of mortgage administrator (one which knows just what real advice say regarding your condition). We can accomplish that for your requirements – call me in the 773-770-4713 or email address Otherwise.

- You will be generous which help your current loan officer pick their way to getting the mortgage recognized with a little let from us and Federal national mortgage association.

Make an effort to file a single in order to a couple-12 months history of work which have a regular level of money, very ensure you get tax returns, W2s, and you will latest spend stubs readily available when you decide just how to go-ahead. You can always get in touch with you otherwise use the chat at the end correct of the web page for those who have significantly more issues.

While doing so, while still at the beginning of your residence to acquire journey, make sure to download all of our free Basic-go out Household Consumer Book! You’ll find out the whole financial approval and you may domestic purchase process action-by-help basic English.