What you need to Understand

- Getting an auto loan that have a deep failing credit score produces it much harder to get approved

- The low your credit rating, the greater number of lenders usually charge you having car financing

- Boosting your credit otherwise dealing with a great subprime lender is your best bet for finding approved

Content

Purchasing a motor vehicle will likely be an exciting experience, particularly if this is your very first vehicles, basic the brand new auto or perhaps the very first auto you’re purchasing in the place of let from your own members of the family.

Unless you can acquire the car with dollars, you will probably need a car loan. Before any vehicle lender decides to leave you a car loan, might examine your credit score.

Exactly what when you yourself have less-than-primary borrowing? Does this imply you can’t pick a car or truck? Can it result in the vehicles of your dreams unaffordable?

Providing a car loan that have bad credit can turn what you will definitely have been a vibrant drive down an open highway for the providing caught inside the rush-hour customers that have a virtually blank container away from gasoline.

However, option pathways come, and help are available. Think about this your vehicle GPS and you will follow these tips.

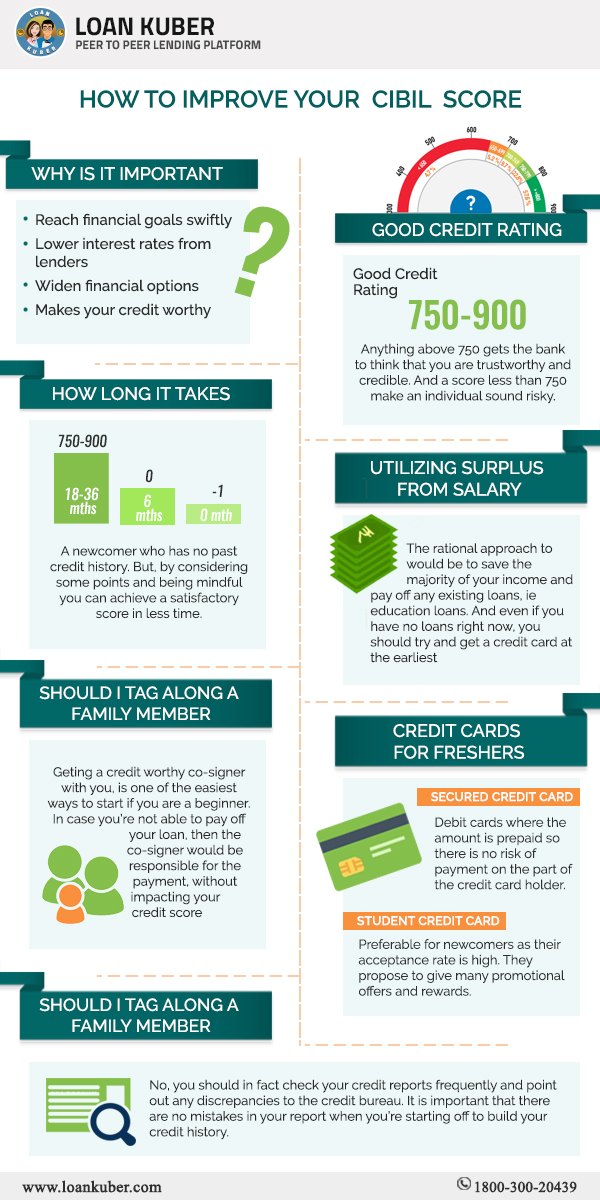

Your credit rating are several regarding 3 hundred to 850. The greater your own get, the higher their borrowing. And the greatest the borrowing from the bank, the more likely youre to locate a lowered rate of interest.

Additionally, which have a woeful credit get, the lending company might want to deny the loan app. When they create accept they, they might be likely gonna fees higher rates of interest.

Considering study off Experian (one of the large about three credit rating enterprises), rates of interest for new and you will used trucks can differ significantly oriented in your credit rating.

If you’re cost change regularly, you can notice that the greatest diving inside the cost goes if your credit rating drops underneath the 600 assortment.

Should your get lands you regarding the subprime classification, you are able to merely be eligible for automobile financing of subprime lenders just who are prepared to give so you can high-chance borrowers and costs high interest levels.

As an instance, for yet another vehicles costing $29,100 with a forty-eight-times loan, a dip off super prime to strong subprime can truly add nearly $two hundred on the payment per month. You to results in thousands of dollars during the attract along side longevity of your car loan.

Understand this You have Poor credit: Delay

- Skipped otherwise later costs

- Having fun with too much of your readily available credit

- To make a good amount of higher orders towards borrowing from the bank in the a brief period of your energy

- Asking for so many credit monitors over a brief period of energy

The latest debtor

Both a tiny personal debt is an excellent matter. If you don’t have one handmade cards otherwise haven’t lent currency on your name or don’t have any monthly bills, you will possibly not has a credit history. Meaning you have a reduced or low-existent credit rating.

You might enhance so it because they build a credit score. Take-out a charge card using your lender or regional merchandising store, or begin purchasing short monthly payments (instance a streaming services membership) by yourself.

Habitual compared to. situational

If you have a credit history, loan providers usually determine as to why your credit score is lower. For individuals who will make ends meet later otherwise bring much regarding financial obligation, you happen to be classified because the having chronic bad credit.

While doing so, whether your low credit rating stems from separation and divorce, illness, sudden unexpected personal debt (such scientific bills) otherwise losing your job, loan providers may see that it as a beneficial situational borrowing from the bank condition and may also be much more forgiving http://www.speedycashloan.net/loans/payday-loans-with-no-checking-account/.

Fraud and identity theft & fraud

It’s also possible to do everything correct and have good low credit rating. In case your identity could have been stolen and you can somebody is utilizing the borrowing from the bank fraudulently, it can wreck your credit rating.

Fortunately which exist your credit score restored for people who statement the problem with the credit reporting agencies.

A 3rd regarding People in the us discovered errors within credit reports. One of those problems is also damage their get. Consult a totally free credit report to see any warning flag.