- Mortgage Brands

- Renovation Home mortgage Qualities

Pro Mortgage Direction has over a decade of experience into the getting sturdy straight back place of work support having Recovery Real estate loan features. Our very own features encompass all of the biggest restoration mortgage loan arrangements such as the typical, Federal national mortgage association Homestyle financing and FHA 203k Finance. Given that a skilled repair mortgage processing team, you can expect your which have a proper-built way to helps loss in mortgage approval turnaround times.

We fool around with greatest community practices, modern-day technical and you can multiple-level file verification strategies in order to maintain quality of their repair home loan mortgage procedure. Regarding right back workplace help having eligibility monitors, examination of SOWs and pre-handling so you’re able to underwriting, possessions appraisal and loan closing, you can expect you which have a practically all-comprehensive solution considering FHA and you can Fannie mae guidance.

Loan Handling

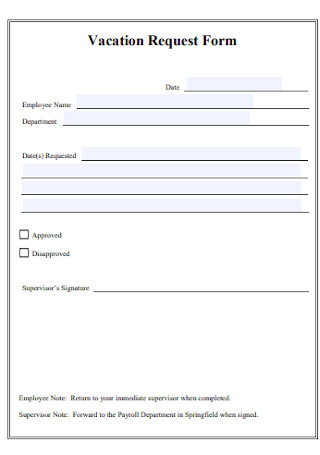

I gather important buyers data files such as for example credit score assessment records, employment confirmation, a career record, shell out stubs and you can loan application variations and opinion them. Asides, we discovered and comment files certain in order to Repair Home mortgage such as once the copies off specialist licenses, insurance coverage, the latest backup of contract between borrower and builder, really works allow toward assets an such like. and you may finish the reputation of customer to possess Homestay and you can FHA 203k mortgage acceptance process. We also make certain the new eligibility requirements of consumer additionally the possessions getting an effective ree on CRM system.

Property Inspection and you may Extent of Work (SOW)

We help loan providers during the performing check of the property adopted because of the knowing the extent out-of work’. Based on the SOW, we ready a document explaining the details of the work to feel done in our house. As the a paid recovery real estate loan features business, i guarantee all the details offered by brand new borrower additionally the contractor on the SOW in order to choose problems relevant on property. With our properties, i ensure the accepted amount borrowed does not result in end up being more than the value of the property following the renovations.

Property Assessment

In place of traditional mortgage loans, restoration mortgage loans try independent of old-fashioned assets assessment process. The fresh appraisal techniques accomplished to possess home-based mortgage loans, dictate the fresh ARV (After Fixed Well worth) of the home. Following the end of one’s appraisal process, we compile more information concerning the renovation try to getting carried from the house in addition to imagine of the home post restoring. Brand new completed information is sent on the financial.

Mortgage Underwriting

We lose all of the correspondence gaps between your underwriter together with mortgage processor chip by directly liaising having both sides. For example a hands-on support framework to suit your underwriting procedure means only confirmed guidance reaches brand new underwriter’s dining table, helping him or her build really-informed decisions. I play with a list-dependent approach to collect all the expected data files including information that is personal out of borrower, assets information, ARV reports SOW declarations etcetera. This will help to switch the rate of underwriting processes.

Financing Closing

I secure and you may dispatch financing packages define disclaimers, mortgage terms and conditions and you will percentage requirements towards debtor. We offer straight back-place of work recommendations on the production of the fresh new escrow membership for the which the repair proceeds are debited. We along with work on the borrowed funds processor to produce and you can file recommendations to guide the brand new debtor during the course of the house or property restoration techniques. The right back workplace service to have restoration home mortgage closure qualities and additionally make it easier to handle consumer requests pertaining to the fresh new escrow membership and amount borrowed detachment.

As to why Outsource Recovery Mortgage loan Characteristics so you can Specialist Home loan Advice?

I’ve adult continuously getting a dependable service spouse away from several several all over the world lenders. By making use of effective team process, i carefully see mortgage requisite, builder profile, assessment documents and you will possessions renovation records make it possible for you dictate the latest appropriate mortgage matter to own a repair. Due to the fact an experienced renovation mortgage loan operating business, i customize a customized way of handle the requirements of Fannie Mae and you will FHA accepted lenders, hence positions us to send lots of benefits eg:

- More ten years of expertise inside recovery home loan services

- Accessibility 1000+ Mortgage masters with experience with dealing with both FHA 203k and you can Homestyle Money

- Right back place of work help which have possessions examination and you will contractor analysis

- Meticulous breakdown of possessions records in order to maintain high http://availableloan.net/installment-loans-ia/augusta quality standards into the the mortgage approval processes

- Back workplace assistance having assets assessment process that is actually specific so you can Renovation Mortgages

- Intricate report on Scope of Functions(SOW) and you may appraisal are accountable to eliminate risks in the mortgage underwriting

- Extremely scalable operations having assistance to improve productivity by doing 50% below increase in work

- Around 31% losing working will cost you and Tattoo

Selecting a talented reline the repair financing handling procedure? Outsource Restoration Mortgage loan characteristics so you’re able to Expert Home loan Guidance to have a keen active solitary avoid solution.